KASS Opposes HB 149 – Education Opportunity Accounts

Quick Talking Points

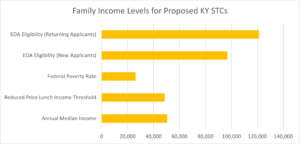

- The bill does not target low-income families. Households making $96,940 per year for a family of four would be eligible – that number becomes $121,175 in income in the second year!

- The bill would mean lost General Fund Revenue, with a potential loss of $205 million in the next five years. This would be the only tax credit in Kentucky to balloon automatically over time.

- The bill does not create accountability for participating schools. Parents do not really have “choice” if they don’t have any data to compare between schools. Private schools do not participate in the state accountability system, do not have to comply with Open Meetings and Open Records, do not have to show data on disproportionality in disciplinary actions, expulsions, and do not have to serve English Language Learners. They can also cherry pick from among the applicant pool to accept only the highest-performing students and turn away students that may be more difficult to serve.

- The bill allows outright discrimination, creates privacy concerns, and could expose families to predatory vendors. Section 11(4) allows education service providers to discriminate against students and families based on their religion or sexual orientation at a minimum. The bill also prohibits unaccompanied youth from participating in the program. Predatory marketing could suck up program dollars without providing any measurable benefit to students and families. And, the bill does not require education service providers (ESPs) and account granting organizations (AGOs) to be FERPA compliant.

Detailed Talking Points

- The bill does not target low-income families.

HB149 was drafted with the intent of providing tax credits to wealthy donors to give families the ability to use public dollars for private school tuition and for education-related expenses for all families. However, the bill would allow discrimination against students and families, would put families at risk of predatory practices and privacy risks, would not allow for public transparency on the use of the funds or the effectiveness of the program in increasing student achievement, and would be used by families who make over $100,000 per year. Further, foster care children from wealthy families would also qualify for the program, as there is no income eligibility for foster care students.

HB149 does NOT target low or medium income families—scholarship eligibility is up to 200% of Reduced Price Meals lunch baseline, or $96,940 household income per year for a family of four. Allowing for increased income of up to 250% of the Reduced Price Meals Threshold for those already participating in the credit would increase the eligibility for this program to $121,175 for a family of four – 2.4x the median income for Kentuckians. Allowing donation of cash or marketable securities further increases the net loss to the General Fund. Also, marketable securities are not defined in Kentucky law.

Data Source: https://www.census.gov/quickfacts/fact/table/KY/INC110219#INC110219

-

The bill would mean lost General Fund Revenue, with a potential loss of $205 million in the next five years.

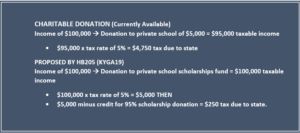

The tax credit proposed in 2021’s HB149 would be the only tax credit in Kentucky to balloon automatically over time. If the fund increases for the next five years automatically, the state will lose $205 million in revenue to the General Fund.

In year 1, the annual lost revenue could be as much as $25 million. In year 5, the annual lost revenue could be as much as $61 million, and cumulative lost revenue could be as high as $205 million. NOTE: For approximately $100 million the legislature could pay for universal Pre-K for 4-year-olds.

- Year 10: annual lost revenue of $186 million (cumulative lost revenue could be as high as $831 million.)

- Year 15: annual lost revenue of $568 million (cumulative $2.7 billion.)

- Year 20: annual lost revenue of $1.7 billion (cumulative $8.6 billion.)

- Tax credits by default reduce general fund revenue to state coffers. As a tax credit, corporations and private donors receive an automatic credit on their tax liability, allowing the amount of the donation to count toward the taxes they would have owed the state. While citizens and corporations can already give scholarships to private schools for student tuition, those donations would be treated like other charitable donations. This bill would also create significant administrative costs to administer at the state level – e.g. administration, oversight, and audits.

-

The bill does not create accountability for participating schools.

The bill does not provide a mechanism for parents to make an informed choice. Kentucky’s private schools are not required to participate in state accountability measures, meaning there is no way to determine which private schools are performing better or worse than their private or public school peers. Specifically, there is no way to measure if a private school is performing better or worse than their private or public school peers in addressing chronic achievement gaps.

- Kentucky’s private schools are not subject to open records and open meetings laws and are not subject to financial or operational transparency. This bill would therefore be used for a program with no public accountability.

- The bill does not include a provision requiring direct recruitment. “Selection Bias,” where engaged parents are more likely to be the ones who take advantage of the program, has a particular impact on this aspect.

- The bill does not define “member of a household,” which could allow for abuse of the program. Would this be an uncle/aunt, grandparent, etc. who stays there occasionally, signs an affidavit assuming educational custody of a child, and claiming their income in order to qualify?

- The bill does not address student achievement in any way, which indicates that the purpose is not to improve student outcomes. Cherry picking of the highest students would not help in addressing the state’s chronic achievement gap.

- Unused funds would go to the AGO rather than being returned to state coffers. This incentivizes AGOs to not use all the funds granted so that they can keep them.

- Allowing AGOs to limit services that the EOA funds can be used for will create inequities and allow nonpublic schools to weed out expensive or “undesirable” students.

- Allowing the AGO to continue funding after a student becomes ineligible (language says they “may” cease funding) incentivizes AGOs to continue using state funds after a family becomes ineligible for the program, which is most likely to occur when a family’s income threshold increases beyond $121,175 of annual income.

- The bill does not prevent Kentucky’s private schools from raising tuition rates for program participants.

- The bill does not cap the amount of funds a student or family could receive, meaning families who make $90,000 or more per year could have unlimited funds given to them for private school tuition or other educational supplies that they could already afford.

-

The bill allows outright discrimination, creates privacy concerns, and could expose families to predatory vendors.

- HB149 does not require criminal background checks for AGOs and ESPs, potentially putting children at risk. Further, it does not require ESPs and AGOs to comply with federal student privacy laws (FERPA). Other concerns include:

- The bill prohibits unaccompanied youth from participating (Section 4(2)).

- The bill does not include CHFS in the definition of a “parent,” but a parent must submit an application to an AGO – CHFS has custody of all foster care children.

- The bill explicitly allows education service providers to discriminate against students and families in Section 11(4) based on their religion and sexual orientation at a minimum.

- ESPs are incentivized to market products to families that students may not need or that may not benefit them. Predatory marketing could suck up program dollars without providing any measurable benefit to students and families.

- There is no provision requiring that any educational therapies collaborate with therapies already being provided at the school, which could create conflicts in care.

- Allowing AGOs to develop their own processes for determining the amount allocated to students will create inconsistency and inequities across the program by allowing private schools to add additional stipulations that could box out minority candidates.

- The bill does not specify how financial need is to be demonstrated, making the program ripe for abuse and inconsistency. (I.e. A signed affidavit may be used by one school, a completed FAFSA at another, copy of tax return at another.)

- The program would not be solely for public school students, meaning public dollars will subsidize private school for students who are already going to private schools.

- Participating private schools would be allowed to “cherry pick” the highest-performing students, students of a certain race, or students of a certain economic background.

Other Concerns

The bill may be unconstitutional. In a recent case in South Carolina, Adams v. McMaster, the court determined that the use of public CARES funds administered by the Governor could not be used to provide private school scholarship tax credits. The decision is based on a provision in the South Carolina Constitution that is akin to Kentucky’s Constitution which prevents public education money from being used for private schools. The opinion reads “Even in the midst of a pandemic, our State Constitution remains a constant, and the current circumstances cannot dictate our decision.” (Read the opinion here: https://www.sccourts.org/opinions/HTMLFiles/SC/28000.pdf). The enactment of private school scholarship tax credits in a pool of funds also designated for public school students may therefore be unconstitutional. Finally, the bill allows parents to intervene in any lawsuit challenging unconstitutionality, which could overly burden the court with one-sided arguments for the credit that have nothing to do with the Constitutionality of the policy.

The bill has significant drafting flaws.

- The definition of an education service provider in this bill does not match the definition already defined in KRS 160.1598.

- The application for becoming an AGO is extremely vague – what are “incorporation documents”? Bylaws? SOS registration?

- Kentucky law does not define “marketable securities,” making this vague provision vulnerable to abuse.

- The bill allows grants for “Services contracted for and provided by a public school system, including but not limited to individual classes and extracurricular activities and programs.” Federal law already requires public schools to provide a “free, appropriate public education” (FAPE). Public schools cannot charge for services, making them ineligible for this.

- The bill allows grants for textbooks, curriculum, or other instructional materials. This could be easily funded through the line item in the education budget that has stood empty for several budget cycles and would allow districts to take advantage of bulk purchasing, making better use of limited public dollars.

- The bill allows grants for tuition or fees for summer education programming. This would aggravate the issue of selection bias.

- The bill does not provide a mechanism for who will monitor appropriate use of funds? Who is going to oversee AGO agreements with parents? Who will be tasked with ensuring that the EOA funds are not used for services they are currently receiving at their assigned public school district? What would be publicly available?